The role of the CFO has evolved beyond financial stewardship. Now CFOs and finance leaders are expected to be strategic partners who provide actionable insights, drive digital transformation, and ensure agility in decision-making. However, with increasing volumes of data, complex compliance requirements, and rapidly shifting market conditions, CFOs face immense pressure to balance both operational efficiency and strategic foresight.

This is where Agentic AI, combined with GenAI-powered Natural Language Query bots, is redefining the CFO’s efficiency. Instead of switching between platforms, creating manual reports, or waiting on analyst teams, CFOs can now ask, act, and analyse, all in one place.

Why Agentic AI for Financial Operations?

Most AI tools stop at recommendations. Agentic AI goes further as it executes tasks on behalf of the CFO. For example, a CFO logs into assistant platform and can get items like:

-

Top Updates:

Get automated highlights on revenue shifts, expense spikes, or margin changes -

AI Recommendations/Alerts:

Receive real-time suggestions, such as adjusting forecasts or monitoring a compliance risk - Agentic Actions:

Go beyond insights and directly perform actions, like:

- Viewing a forecast dashboard

- Generating ERP reports

- Triggering anomaly detection

- Executing any custom financial workflow with a simple command

This makes Agentic AI a true co-pilot for finance leaders that can handle routine yet critical actions instantly while ensuring CFOs stay focused on strategic priorities.

NLQ Bots: From Prompts to SQL to Insights

Game-changer for CFOs is the use of NLQ bots powered by GenAI and RAG (Retrieval Augmented Generation). Instead of relying on BI teams to prepare queries or reports, CFOs can simply type or speak a question like: “What was our Q3 revenue growth in APAC vs. EMEA?” and get instant answers: The bot converts the query into SQL, fetches the data from financial systems, and provides a summarized response in plain language.

With this, CFOs can explore deeper with context: RAG ensures that answers are not generic but grounded in your enterprise’s data sources and historical context.

This means a CFO can move from a question to getting SQL queries to getting chart/summary to make decision within seconds. Voice or text prompts replace technical complexity, turning finance analytics into a conversational experience.

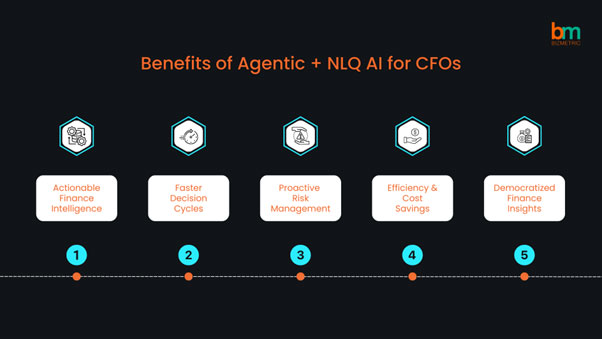

Benefits of Agentic + NLQ AI for CFOs

Here are key benefits of using NLQ Bots for financial leaders:

-

Actionable Finance Intelligence

Instead of dashboards full of KPIs waiting for interpretation, CFOs get curated updates and AI alerts, followed by the ability to execute actions in real time. -

Faster Decision Cycles

With NLQ bots, finance leaders don’t wait on analyst teams. A single voice prompt can deliver an SQL-driven analysis and a strategic recommendation. -

Proactive Risk Management

Agentic AI continuously monitors data, triggers anomaly detection, and notifies CFOs of compliance or fraud risks, often before they become material. -

Efficiency & Cost Savings

Automating ERP report generation, reconciliations, and forecast updates frees up finance teams, reducing manual overhead by 50–70%. -

Democratized Insights

Non-technical executives can interact with finance data in natural language, ensuring every decision-maker has access to relevant, real-time intelligence.

Bizmetric is Leading the Future of Agentic AI for CFOs

Bizmetric specializes in building Agentic AI and GenAI-powered NLQ bots tailored for finance leaders. Our platforms don’t just show data, they act on it to give insight within seconds. With RAG-enabled intelligence, CFOs get precise answers from enterprise systems, while Agentic workflows let them instantly trigger actions like generating ERP reports or updating forecasts.

By blending conversational analytics with autonomous execution, we help CFOs achieve:

- Smarter financial planning and analysis (FP&A)

- Proactive anomaly and risk detection

- Faster, voice- or prompt-driven insights

- A finance function that is more efficient, accurate, and future-ready

Ready to Empower Your CFO Office?

CFOs no longer need to choose between speed and accuracy. With Agentic AI and NLQ bots powered by GenAI, they can have both, real-time insights and immediate actions. We also have built many more agnetic AI solutions to streamline your business operations.

Bizmetric is among the best in enabling CFOs with Agentic AI and GenAI solutions. Let us help you transform finance into a faster, smarter, and more resilient function. Want to know more? Contact our experts right away!

Write a Reply or Comment

You must Register or Login to add a comment.